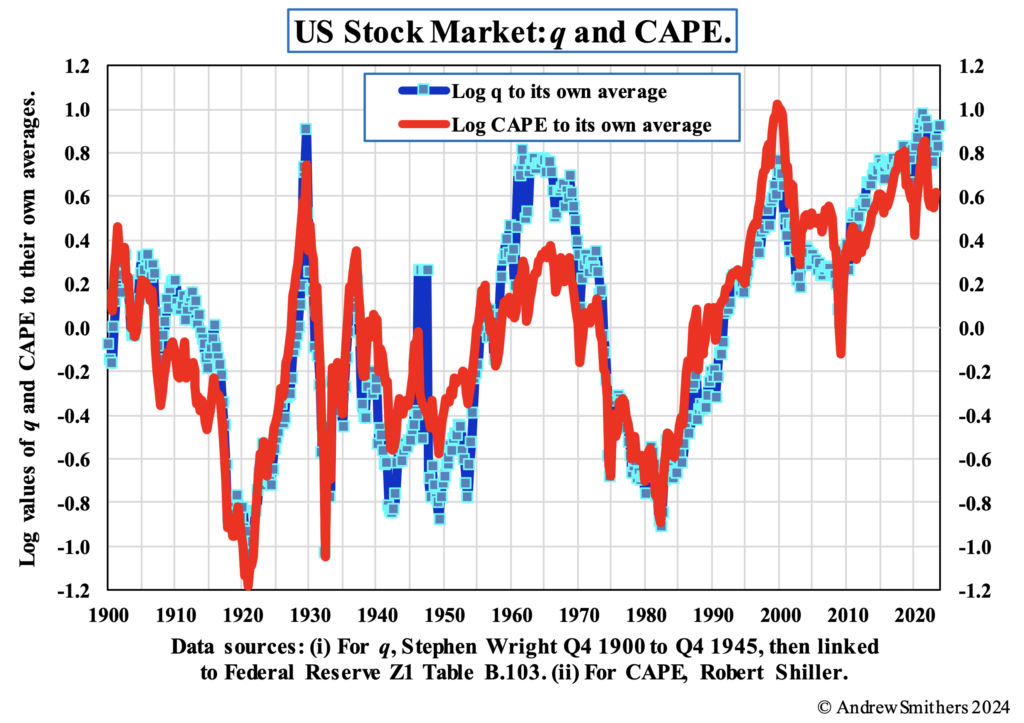

US CAPE and q chart

|

|

S&P 500 |

q Value |

CAPE Value |

|

At 30th June 2023 |

4345.37 |

81.63% |

84.60% |

|

30th September 2023 |

4,328.18 |

77.06% |

83.87% |

|

30th December 2023 |

4769.83 |

95.13% |

91.8&% |

|

28th March 2024 |

5248.49 |

114.03% |

101.90% |

The q data are updated to 31st December 2023 and for CAPE to 30th September 2023. I show the valuation of the US stock market at the end of each of the last 3 quarters of 2023, adjusting for changes in the S&P 500.

The q values are taken from Z1 Table B.103 and show a smaller degree of overvaluation than that used in the Chart, which compares the log value of both q and CAPE with their own averages. The value for q as shown in Table B.103 probably understates the degree of overvaluation because: (i) The depreciation rate used by the BEA for IP should be 100% and not the current rate used of around 24% (latest data 2021). (ii) As the aim is to value the stock market, there should be no discount attributed to unquoted (closely held) companies. The discount used appears to be 25%.

Data for my calculations of q are taken for 1900 to 1952 from Measures of Stock Market Value and Returns for the Non-financial Corporate Sector 1900-2002 by Stephen Wright, published in the Review of Income and Wealth (2004) and for 1952 to 2023 from the Financial Accounts of the United States (“Z1”), published by the Federal Reserve. Data for our calculations of CAPE are taken from the data published on Robert Shiller’s website, updated if necessary from data published by Standard & Poor’s. Data on net worth are only available annually before 1952 and I have calculated the quarterly data by interpolation assuming that changes are evenly spread over each year. Market value data are calculated by adjusting the year-end figures for the quarterly value of the S&P 500 or its equivalent as shown by Robert Shiller.

Andrew Smithers

London

28th March, 2024.